The smart Trick of Opening An Offshore Bank Account That Nobody is Talking About

Table of ContentsNot known Factual Statements About Opening An Offshore Bank Account Not known Incorrect Statements About Opening An Offshore Bank Account Opening An Offshore Bank Account Fundamentals ExplainedThings about Opening An Offshore Bank AccountOpening An Offshore Bank Account Fundamentals ExplainedAll About Opening An Offshore Bank Account

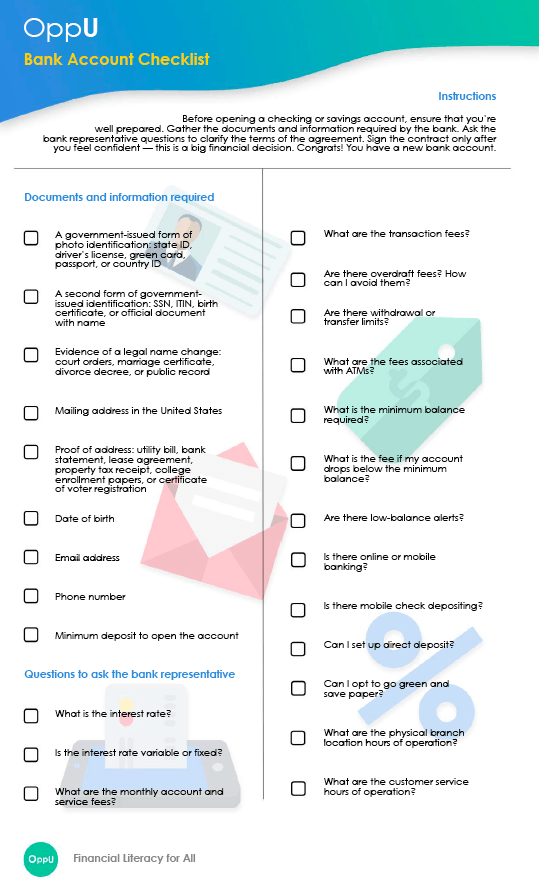

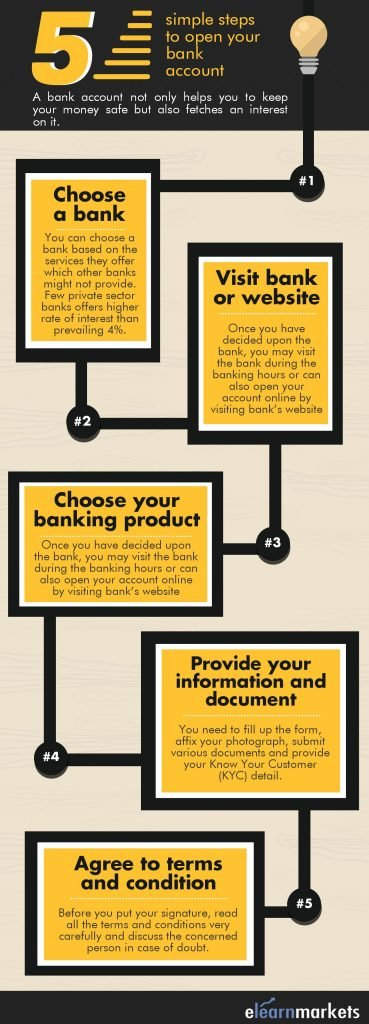

Whether you're thinking about transferring to the UK or you've shown up there currently, at some time you're mosting likely to need a savings account. In the past, opening a financial institution account in the UK was really challenging if you were brand-new to the country. The good news is, nowadays, it's become a little much easier (opening an offshore bank account).As soon as you've altered your address, ask your bank to send a financial institution declaration to your brand-new address by blog post, and you'll have a paper that shows your UK address. If you do not have an evidence of address in the UK and also you need to open an account, Wise's multi-currency account may be the ideal selection for you.

Can I open a checking account prior to I show up in the UK? Yes, you can. Your house financial institution might be able to establish a make up you if it has a reporter financial partnership with a British financial institution - opening an offshore bank account. Many significant UK financial institutions also have so-called. These are created especially for non-residents, so they're a great option if you do not have the documents to confirm your UK address.

The Only Guide for Opening An Offshore Bank Account

This can make your checking account costly to open up as well as run, specifically if you still do not have a task. There may likewise be other limitations. You might not be able to close the account and also button to a much better deal until a collection period of time expires. The Wise multi-currency account.

Some banks are rigorous with their demands, so opening a savings account with them will be difficult. What is the most convenient bank account to open up in the UK? It's typically easier to open up an account with one of the - Barclays, Lloyds, HSBC or Nat, West. These financial institutions have actually been in organization for a long period of time and are extremely secure.

Some Ideas on Opening An Offshore Bank Account You Should Know

Nonetheless, the are Barclays, Lloyds, HSBC and Nat, West. Let's have an appearance at what each of them need to supply. Barclays Barclays is just one of the earliest banks in the UK; and has greater than 1500 branches around the country. It's also probably Continued one of the simplest financial institutions to open up an account with if you're new to the UK.

The account is cost-free as well as features a contactless visa debit card as criterion. Nonetheless, you won't be able to use your account promptly. When you're in the UK, you'll have to visit a branch with your reference number, passport and proof of address in order to turn on the account.

Barclays also provides a couple of different business accounts, relying on the yearly turn over rate. You can contact client assistance through a real-time chat, where you can discuss the details of your application and also ask questions in real time. Lloyds Lloyds is the biggest service provider of current accounts in the UK, and has about 1100 branches throughout the country.

Fascination About Opening An Offshore Bank Account

You can get in touch click to investigate with client assistance by means of a live conversation, where you can talk about the information of your application as well as ask any concerns in real time. Various other banks worth checking out While Barclays, Lloyds, HSBC as well as Nat, West are the four biggest banks in the UK, there are additionally various other banks you can inspect.

Of course, it's constantly best to look at what various banks have to provide and also see who has the finest deal. You can get a basic current account at no month-to-month price from many high road banks.

Many banks also have superior accounts that provide added advantages such as cashback on house expenses, in-credit rate of interest as well as insurance. These accounts will certainly often have month-to-month charges and also minimum qualification requirements; as well as you might not certify if you're brand-new to the UK. You'll additionally need to be cautious to remain in credit history.

Opening An Offshore Bank Account - The Facts

If you're not utilizing one of your bank's ATMs, examine the device. Numerous financial institutions will charge a, which can be as high as 2.

When you open this account, you'll have the alternative to take out an. An arranged overdraft permits you to obtain money (up to a concurred limitation) if there's no money left in your account.

Some Ideas on Opening An Offshore Bank Account You Should Know

Nevertheless, we'll constantly try to enable essential repayments if we can. You can apply for a prepared overdraft account when you open your account, or at any time later on. You can ask to raise, remove or lower your limit any time in online or mobile financial, by phone or in-branch.

We report account task, consisting of overdraft usage, to check that debt reference companies. This account comes with a.